Value vs. Growth: Why Value Funds matter in 2023?

As the COVID-19 pandemic unfolded, growth investing gained momentum while traditional value investing took a backseat. However, the market scenario has changed in early 2022 with rising interest and inflation leading to renewed interest in value investing.

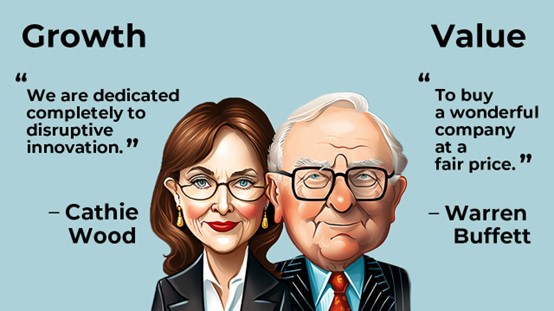

Warren Buffett’s investment philosophy emphasizes buying a wonderful company at a fair price over a fair company at a wonderful price. In 2022, value stocks in which Buffett and his company Berkshire invested performed remarkably well. For instance, some of the value stocks the company invested rose by 109% during the year. In contrast, Cathie Wood, who advocates for investing in growth stocks, saw her ARKK top holding, fall by 65% during the same period[1]. It is essential to understand that different strategies may work at different times.

In 2023, traditional value investing may potentially generate strong returns amid market volatility and economic uncertainty. In this article, we will talk about the reasons behind.

What is value fund?

A value fund is a type of fund that invests in stocks that are considered undervalued by the market[2]. The goal of a value fund is to achieve capital appreciation by investing in companies that are currently priced lower than their intrinsic value, and therefore have the potential to increase in value over time as their true worth is recognized by the market.

Key features of value funds:

1.) Focus on undervalued stocks, which are trading at a discount to their intrinsic value: This is determined by metrics such as the price-to-earnings ratio, price-to-book ratio, or dividend yield. By investing in undervaluedstocks, value funds seek to achieve capital appreciation over time as the stocks’ true worth is recognized by the market.

2.) Strong emphasis on fundamentals: Value fund prioritize companies with solid fundamentals, such as a history of stable earnings and revenue growth, as well as strong balance sheets and reliable cash flows. By investing in companies with strong fundamentals, value funds aim to reduce the risk of investment loss and achieve long-term growth.

3.) Tend to have a long-term investment horizon: Value funds is holding onto investments for several years in order to capture the full potential of the undervalued stocks. This long-term perspective allows value funds to ride out short-term market fluctuations and achieve higher returns over time. It also aligns with the philosophy of buying and holding quality companies at a fair price, rather than trying to time the market or invest in short-term trends.

What is the difference between value and growth?

Growth is typically characterized by their potential for significant revenue and market share growth in the future[3]. These companies often choose to reinvest most of their profits back into the business rather than distributing dividends to shareholders.

On the other hand, value represent shares of companies that are currently undervalued by the market. This undervaluation is based on metrics such as price-to-earnings ratio, price-to-book ratio, or dividend yield. While these companies may possess solid fundamentals and generate steady cash flows, they may be overlooked or undervalued by investors. Value stocks often choose to distribute dividends to shareholders rather than reinvesting profits back into the business.

Why value funds matter in 2023?

Value funds may be a viable investment option in 2023 due to several factors.

Firstly, as the Federal Reserve raises interest rates to combat inflation, the prices of value stocks may trade lower than the market rates. The impact of rising interest rates has already influenced the valuation of growth stocks. Considering that interest rates may continue to rise this year, albeit at a slower pace than in 2022, lower-valued value stocks may continue to be favored by investors, particularly in light of the current weak global economy and lackluster revenue growth.

Secondly, in times of market turmoil, value stocks have historically performed better than growth stocks due to their strong cash flow and stable revenue, making them more resilient to economic headwinds. It is important to note that the performance of value and growth stocks is cyclical. For example, growth stocks outperformed in the ‘90s during the dotcom era and have performed extremely well over the past decade[4]. Value stocks outperformed from 2001-2008 as investors placed a greater value on dividends and stock valuations. This cyclical behavior highlights the benefits of having both types of investments in a portfolio.

Thirdly, during times of inflation, value stocks tend to have strong current cash flows that are more stable and may grow slowly or diminish over time, whereas growth stocks are typically associated with fast-growing companies that may not yet be profitable. Consequently, when valuing stocks using the discounted cash flow method, rising interest rates tend to have a more negative impact on growth stocks than on value stocks. This is because interest rates are often raised to combat high inflation, which means that growth stocks tend to suffer more during times of high inflation compared to value stocks.

In conclusion, due to the Federal Reserve’s interest rate policy, the impact of rising interest rates on growth stocks, and the historical performance of value stocks in times of market turmoil and high inflation. However, it is important to conduct your own research and consult with a financial advisor before investing to ensure that the investment aligns with your investment goals and risk tolerance.

If you would like to understand more about value funds and its opportunities, you may contact your dedicated financial advisor or leave your contact details at contact us form. Our representative will contact you shortly.

[1] Data from Bloomberg; [2] Data from Investopedia; [3] Data from Investopedia; [4] Data from Hartfordfunds

#Disclaimer and Notes

Investment involves risk and past performance is not indicative of future performance. The content of this article is for reference only, and OnePlatform Asset Management Ltd. shall not be liable for any loss or damage caused by any person’s use or misuse of any information or content, or reliance on it.

Fund products and portfolio management services are distributed and/or rendered by OnePlatform Asset Management Limited (a licensed corporation with SFC CE No. AFQ784).

You May Be Interested In

OnePlatform Asset Management | 01 Oct 2024

Monetary Policy Shift in China – Analyzing Market Reactions to RRR Reduction

OnePlatform Asset Management | 09 Sep 2024

Investing Made Simple: Why You Should Choose Bond Funds Over Individual Bonds

OnePlatform Asset Management | 03 Jan 2024

Embracing Market Uncertainty: The Appeal of Multi-Asset Investments